Bullish China: More room to run with reopening, supportive policy and attractive valuations

Positive China Equities, modest and front-loaded CNY strength. Risks: sharp spike in oil prices, US hard landing and new COVID variants

China’s decisive pivot away from zero-COVID: Over the past two months, China has moved expeditiously to dismantle its zero-COVID policy. The latest announcements on 26 December effectively removed the last vestiges of the zero-COVID regime by downgrading the designation of the virus, removing quarantine measures and reopening to inbound travelers, among other measures. Outbound tourism will also be restored gradually (see link here).

Reopening of China’s economy to continue, and at a faster pace than the market expects: The virus spread in China has been ferocious especially in urban areas, with one estimate suggesting a massive 250 million infections within just 20 days and 37 million in one day (see here). Half of the passengers on a China to Italy flight tested positive for COVID, corroborating estimates of widespread infection. More importantly, hospitalisations and fatalities are a far cry from the Armageddon scenario often painted by Western media. While hospitals across China are generally packed, doctors and nurses short-staffed, and over-the-counter fever medicine in short supply, the medical situation remains within implicit thresholds of policymakers. Chinese authorities are also working hard to ramp up supply of ICU beds, fever clinics and medicine, especially in less developed areas. I expect reopening to continue, with peak infections nationwide coming as soon as late-January to mid-February (see link for an analysis).

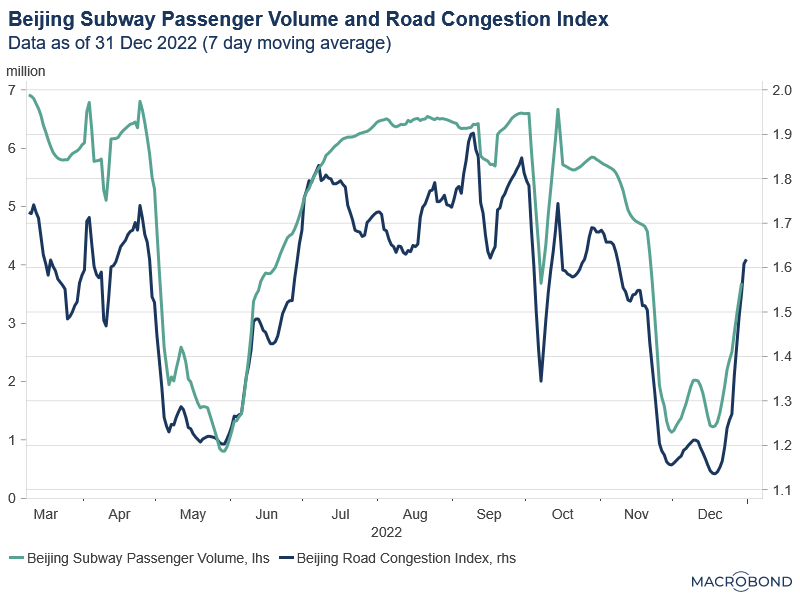

Chart 1: Traffic mobility in Beijing has rebounded over the past week, providing a template for economic recovery in other regions over the coming months

Policy turning more pro-growth: Beyond zero-Covid, what's changed is a more concerted and coordinated effort to support the weak property market. In particular, the government's "16 point" plan released in November seeks to increase financing to high-quality developers and delivery of stalled projects. In this context, the recently concluded Central Economic Work Conference (CEWC) has set a clear pro-growth tone for 2023, emphasising the need to stabilise the property sector to prevent economic and financial risks, while also avoiding a return to over-leveraging (see link here and here). Policy priorities to support growth also include measures to support tech companies to boost employment, while implementing a "prudent" monetary policy and "proactive" fiscal policy. Overall, I expect policy to turn more accommodative through 2023 especially on the property market and tech sector, although coupled with a slightly less expansionary fiscal stance (see link).

Chart 2: China government’s concerted efforts to increase financing to high-quality developers should help put a floor to the weak property market in 2023

China's growth to surprise to the upside in 2023. Consumption to recover strongly, more than offsetting an export slowdown: Assuming no lethal Covid-19 variants emerge, I expect China's growth to surprise on the upside as economic reopening accelerates, and aided by accommodative policy. Consumption spending especially in close-contact services (eg. retail and entertainment) should lead the improvement as mobility rebounds, employment picks up, and households draw down on elevated savings. This should more than offset an export slowdown due to weak demand in the US and Europe and elevated goods inventory. Meanwhile, investment is expected to remain flat. Policy easing in the property market puts a floor to construction activity, but this should be offset by slower public infrastructure and manufacturing investment.

Chart 3: China’s consumption spending was weighed down significantly by zero-COVID restrictions in 2022. This should change in 2023 as the economy reopens

Bullish Chinese equities - earnings improvement amid cheap valuations and depressed expectations. Mildly bullish China IG and HY, but credit differentiation to remain given property market overhang: Valuations for MSCI China look quite attractive both relative to its own history and compared with other major markets such as the US (Fwd P/E at ~10.5 in China vs ~17-18 in the US). I think Chinese equities have room to run, with consumer discretionary stocks and reopening proxies (eg. airlines and banks) likely to lead the improvement. Chinese investment grade and high yield credit have some value given significant widening of spreads over the past 2 years, but I expect credit quality dispersion to remain a feature in 2023. This is especially the case in the hard-hit property sector, where policy is seeking to support developers with strong balance sheets while preventing a return to over-leveraging.

Chart 4: MSCI China’s valuation looks reasonable

Source: Yardeni Research (see link here)

CNH - front-loaded and modest appreciation in 1H2023 as portfolio inflows compensate for a narrower current account surplus: The story for FX is more nuanced. China’s current account surplus is likely to moderate through 2023, initially as exports slow further, and subsequently reflecting stronger imports and tourism outflows as domestic demand pick up and borders reopen fully. Nonetheless, the import boost may be somewhat more muted this time round given the services-oriented recovery (as opposed to goods), coupled with weak investment activity, which tends to be more import intensive than consumption. On the capital account, I expect portfolio inflows to pick up as sentiment improves and markets price in an economic recovery, helping to offset the narrower current account surplus mentioned above. In addition, exporters have been hoarding USD as the Chinese currency weakened in 2022, and could start to convert more FX as economic activity and sentiment picks up.

Chart 5: Stronger foreign portfolio inflows should help offset narrower current account surplus in 1H2023

Chart 6: Exporters hoarded more FX in 2022 as RMB weakened. This could change as sentiment around the economy improves in 2023

Risks to watch for - sharp spike in oil prices and US hard landing recession: There are two key risks I'm watching for. First, a sharp spike in oil prices as China's reopening boosts oil and energy demand, ultimately spilling over to inflation globally. While China's reopening should be positive for mobility-related oil products such as gasoline and jet fuel, this should be offset somewhat by weak exports which could weigh on diesel demand (see link here to comments by a senior official from Sinopec on expectations for 2023). Second risk is a hard landing recession in the US which negates the positives from China’s reopening. My base case is for US growth to slow below trend but remain positive, even as inflation and the labour market in the US moderates enough to allow the Fed to pause its rate hike cycle. A US severe recession would certainly have negative spillovers to the rest of the world, including China.

Trades - Buy MSCI China, Short USDCNH: I think the risk reward for MSCI China (MCHI) still looks good, despite the run-up over the past two months. Meanwhile, CNH has room to appreciate against the US Dollar in 1H2023 as portfolio inflows pick up while imports remain at relatively low levels.

Buy MCHI at 47.6, stop loss at 35

Short USDCNH at 6.922, stop loss at 7.05

Tactical Asset Allocation recommendations - Buy China Equities, sell US Equities: From a portfolio perspective, I'm funding an overweight position in China equities using an underweight position in US equities.

Underweight equities

Overweight China equities

Neutral Asia and EM equities

Strong underweight US equities

Neutral Europe and Japan Equities

Neutral government bonds and duration

Underweight Credit

Overweight investment grade

Underweight high yield

Modest overweight in commodities (hedge against unexpected inflation)

Modest overweight in cash