Climate Change - Adaptation with Mitigation

Our cumulative emissions so far have set in stone our climate's trajectory over the next ten to twenty years

Climate change is no longer a hypothetical risk. The science tells us that it is coming faster and deeper than we earlier envisioned, and with greater certainty surrounding the potential outcomes (see link here to the latest IPCC AR6 report).

Investor interest has soared accordingly, with clean energy funds for instance outperforming the broader market by more than 90% over the past two years, and inflows continuing to rise.

Despite the strong growth so far, I believe that we are only in the early days of a monumental shift towards a greener and more sustainable future.

Climate change will be one of, if not the biggest, megatrend we will witness in our lifetimes, and one which will have significant and wide-ranging impacts on investment portfolios, both from a risk and opportunity perspective.

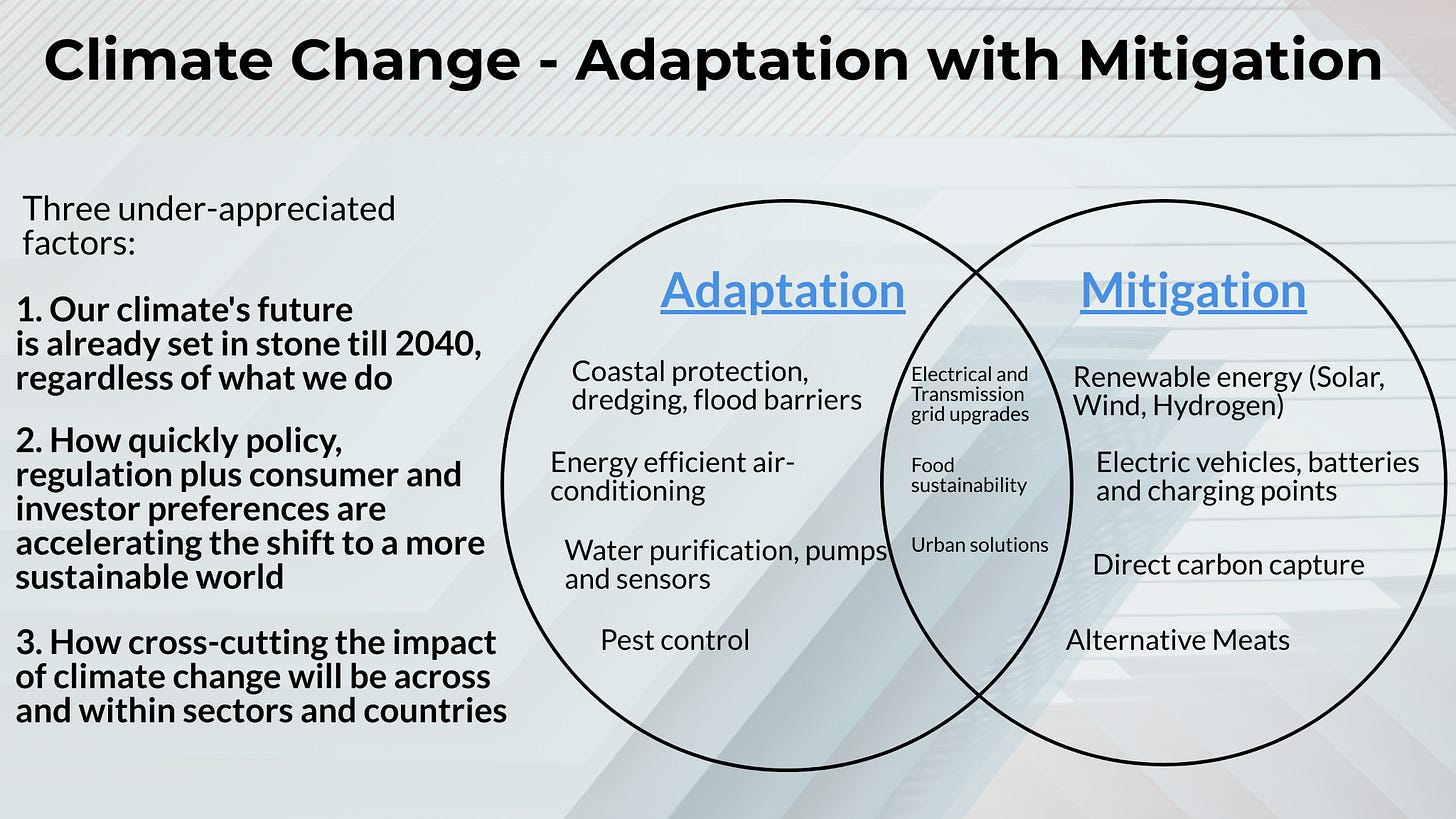

I think three factors remain vastly under-appreciated by markets in the climate change discussion thus far.

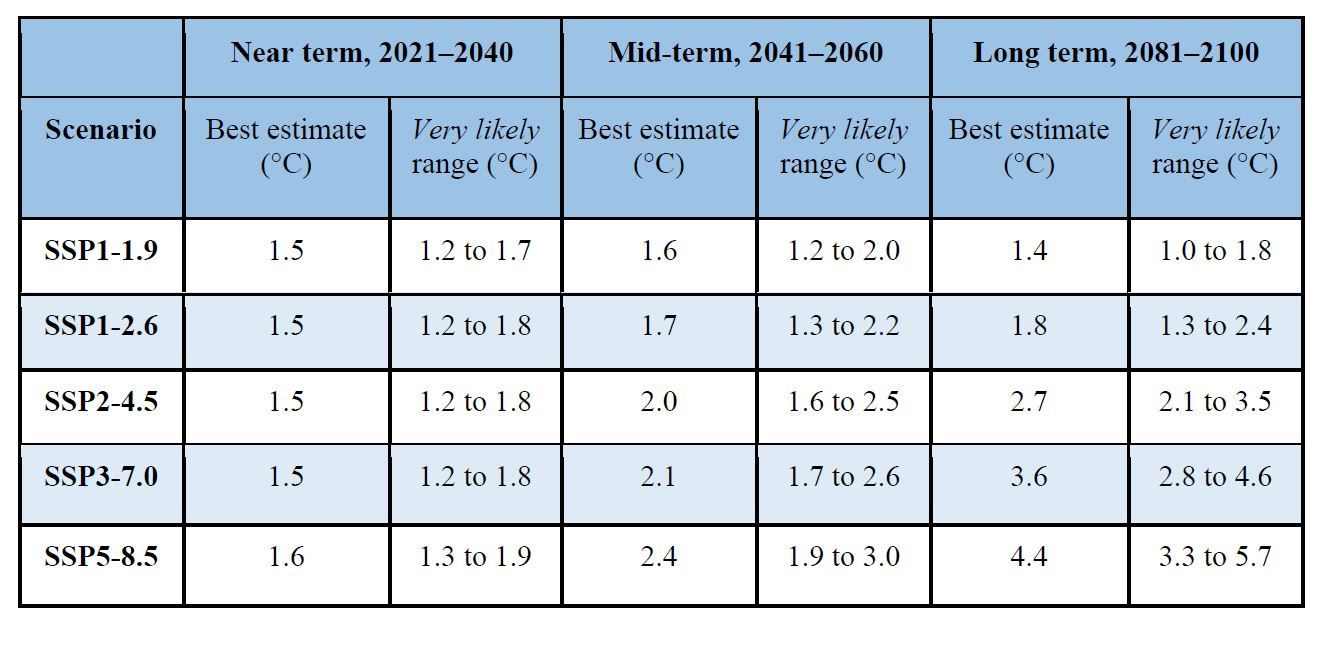

First, many market participants do not realise that much of our climate’s future has already been baked in over the next one or two decades till 2040, regardless of our Greenhouse Gas (GHG) emissions from here (see Chart 1 below).

This is in part because it takes a long time for the earth’s mass to heat up and achieve an equilibrium based on past emissions, and in part because greenhouse gases such as carbon dioxide take hundreds to thousands of years to break down.

Put differently, our cumulative emissions so far have already set in stone our climate’s trajectory at least over the next ten to twenty years.

Chart 1: Nothing we do now can change the trajectory of our climate’s over the next one to two decades - average temperatures based on scenarios in the IPCC’s Sixth Assessment Report

As such, efforts to adapt to a permanent reality of higher average temperatures and more extreme weather will have to accelerate, even as we attempt to reduce GHG emissions to mitigate climate change and avoid far worse scenarios for our future generations (see investment implications section below).

Second, many underestimate how quickly changes in policy, regulation plus consumer and investor preferences are coming together to accelerate the shift towards a sustainable world.

These include:

An increasing focus on ESG factors by investors and consumers (including those related to the climate);

Greater demand for holistic assessments of climate-related risk by financial institutions and regulators, across transition risks, physical risks, and stranded asset risks;

The rollout of global standards over the next few years, helping to raise transparency and consistency of sustainability and climate-related disclosures, including through the Task Force for Climate-Related Financial Disclosures (TFCD) and the Financial Accounting and Standards Board (FASB)

I believe these shifts have staying power as they are underpinned by drivers such as permanent changes in consumer preferences, and recognition of climate-related financial stability risks by regulators. In turn, these changes can go a long way in allocating capital in a more efficient and socially-optimal way through banks, financial institutions and the capital markets.

Third, many still under-estimate how cross-cutting the impact of climate change will be, and believe it mainly affects companies directly involved in fossil fuels, such as coal mining firms.

The reality is that climate change will have a sizable impact across all sectors and countries “horizontally”, akin to how technology continues to transform and disrupt sectors in myriad ways. More importantly, climate change will (as with technological disruption) result in higher dispersion between the winners and losers both across and within sectors and countries.

Investment Implications: Adaptation and Mitigation for a greener and more sustainable future

The full investment implications go deep and broad, and are beyond the scope of one article to address and encapsulate.

At a high level, I think it is useful to frame the investment implications and opportunities in three big buckets: Mitigation, Adaptation, and Adaptation with Mitigation.

1) Mitigation: This involves decarbonising our economy to reduce the negative impacts of climate change. Possible beneficiaries include:

Investments in companies involved in renewable energy production such as solar, wind and hydrogen.

Makers of electric vehicles, batteries and charging points

Those involved in developing technologies for direct carbon capture

Companies in alternative meats, to reduce methane emissions from livestock through enteric fermentation

2) Adaptation: Adapting to living well with climate change is just as important as mitigation, as we explained above. Investment ideas include:

Companies benefiting from coastal protection, dredging, flood barriers to mitigate against sea level rises and storm surges from extreme weather

Companies benefiting from the development of energy efficient air-conditioning, to combat heat waves and higher average temperatures

Those in water purification, water pumps, and water sensors, to combat against droughts and water scarcity

Production of impact resistant glass, which can guard against hurricanes and storms

Pest control companies, as global warming trigger changes in the distribution and population of insect pests

3) Adaptation with Mitigation: Efforts to adapt to living with climate change can also help in decarbonisation. Those in this bucket include:

Companies benefiting from Electrical and Transmission grid upgrades. These can help provide greater resilience in the electricity grid arising from more extreme weather conditions, while supporting the transmission of renewable energy, which tends to be more intermittent and unpredictable.

Solutions improving the sustainability, efficiency, and resilience of food production, including precision agriculture. Adapting to more extreme temperatures requires food sources which are more resilient, but also at the same time, being more efficient in terms of water and fertiliser usage for instance

Companies benefiting from urban solutions. As the climate changes, cities will have to adapt massively, to become both more resilient against extreme weather conditions and also more efficient in electricity utilisation.