How bad will this COVID-19 wave be in the US?

To get to the vaccine, we need to go through a rough winter first

The recent announcement of Pfizer and BioNTech's vaccine result is fantastic news, providing hope for a broader economic recovery globally in 2021 (see link here).

Nonetheless, vaccine approval is far from a silver bullet in the near-term. There will not be enough vaccines for distribution at the first instance, and the focus will be to first inoculate the most vulnerable and those at the front lines.

Meanwhile, the US continues to see a tremendous surge in COVID-19 cases as we head into the winter season. The market’s focus could very quickly shift back to the economic implications of the pandemic in the US, while keeping an eye out on the longer-term impact of a vaccine.

My detailed state-by-state analysis of COVID-19 data indicates US economic growth will likely surprise to the downside in the winter months, as various states increasingly implement mobility restrictions.

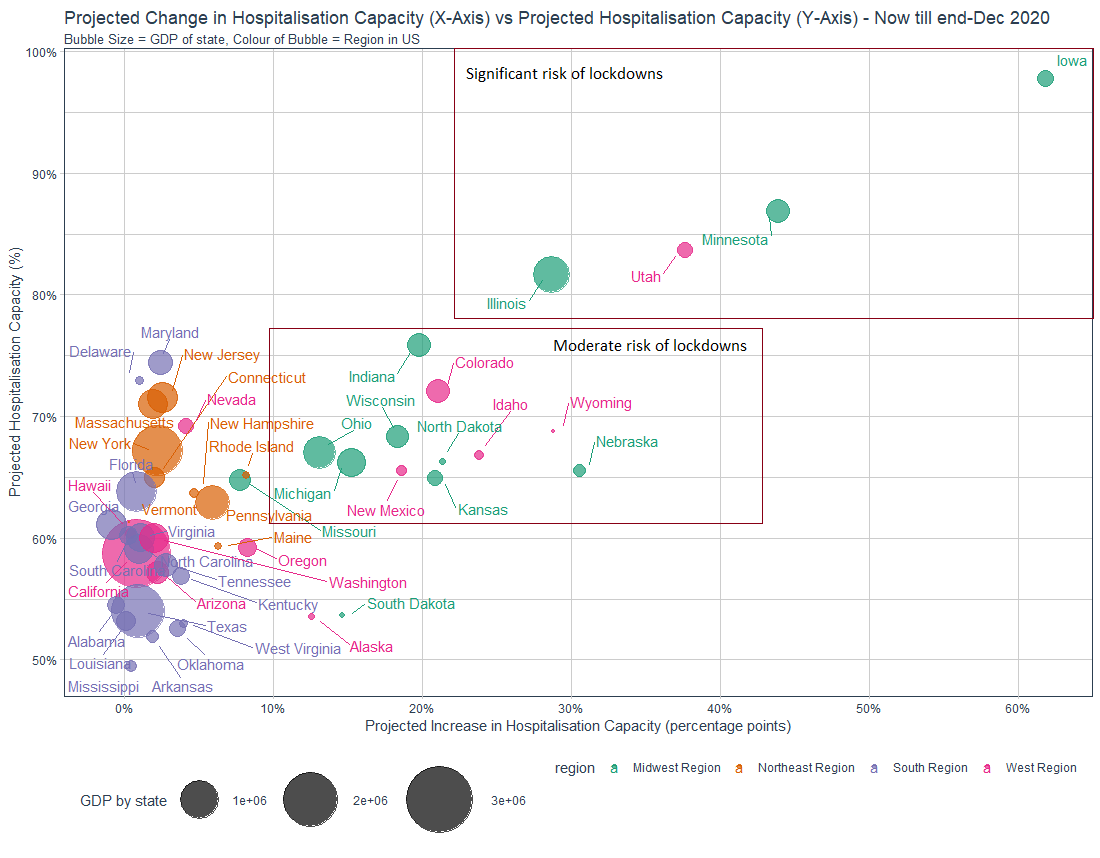

In particular, four states accounting for 8% of US GDP are most severely at risk of economic lockdowns, with hospital capacity expected to exceed 80% by the end of the year based on my projections (see image below and also next section for more details). These are Iowa, Minnesota, Utah, and Illinois.

Another 10 states are at moderate risk of implementing mobility restrictions. These include Ohio, Michigan, Wisconsin, Iowa and Colorado, and they make up an additional 12% of US GDP.

Further downside risk to economic growth could come if the virus spread broadens to other states as people travel more intensively during the upcoming Thanksgiving holiday season.

My analysis suggests the following investment implications:

Remain overweight global equities from a strategic perspective given the more positive outlook on the vaccine.

Nonetheless, I would wait for better clarity on the virus situation in the US before adding more risk to the investment portfolio, given the significant run-up in the markets we have already seen post the US Election and vaccine news

As we get better clarity on the winter surge, I recommend shifting some allocation tactically at the margin out from EM Asia (mainly China) and towards the US and Europe, reflecting how a vaccine should provide a sharper growth boost in the latter two economies.

I expect rotation trades away from growth towards cyclicals and value stocks to gain more prominence as we head into 2021.

Details: Projecting hospital capacity in the US

I detail my work in projecting hospital capacity in the US below. The first key point to make is that we should not look solely at aggregate cases and hospitalisation to gauge the economic impact:

First, confirmed cases during the Spring lockdown severely under-represent the “true” cases, because testing capacity was significantly constrained back then. The share of positive tests reached ~20% at the peak in March, indicating that the US was detecting only the most severe cases.

Second, the aggregate numbers mask how cases are distributed across states. This is important because different states have varying ability to cope with the rise in hospitalisations. In addition, individual states are responsible for implementing movement restrictions, and not the US Federal Government.

As such, we should look more closely at how individual states are coping with the virus, in order to accurately gauge the economic impact of the rise in COVID-19 cases.

While there are websites which provide projections of cases and hospitalisations based on epidemiological models (for example see here and here), the key drawback is they tend to be updated with a lag.

Given how quickly the virus situation is evolving in the US, I have decided to use a less "precise" approach, but one which allows me to update my views based on daily information. In particular, I used a standard time series model called ARIMA in order to forecast cases based on each series' past history (see results in chart below).

Of course, significant caveats apply. For instance, I am not able to model movement restrictions and human behaviour, and the feedback loop to case growth. As such, the model could tend to overstate cases. On the flipside, the model does not take into account the number of undetected cases, and would have the effect of understating the rise in cases.

I subsequently translate forecasted COVID cases using the ARIMA model to current hospitalisation capacity, using typical historical relationships based on a regression.

These simulations have significant uncertainty surrounding them, and a lot can change depending on the actions of states to combat the virus.